Boynton Beach, FL Probate Process for Residents & Non-Residents

In Florida, probate is a court-supervised process in which a deceased person’s assets are identified and beneficiaries are determined. The probate process is designed to ensure that potential creditors have an opportunity to pursue claims against the estate, as well as provide a forum for identifying the correct beneficiaries to receive the decedent’s property.

In Florida, probate is a court-supervised process in which a deceased person’s assets are identified and beneficiaries are determined. The probate process is designed to ensure that potential creditors have an opportunity to pursue claims against the estate, as well as provide a forum for identifying the correct beneficiaries to receive the decedent’s property.

Florida Probate Process in Florida

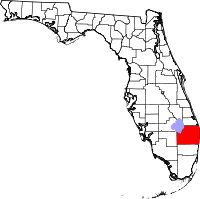

When someone passes away leaving a valid Last Will & Testament, anyone with possession of the Will must file the original document with the correct circuit court, aka probate court. The original Last Will & Testament and any probate pleadings will be filed in the county of the last residence for the decedent. If the decedent passed away as a resident of Boynton Beach, then Palm Beach County would be the correct jurisdiction for a domiciliary probate proceeding. If there is no Last Will & Testament for the decedent, then any probate assets will be distributed according to the Florida intestacy statute, which provides a default distribution scheme for assets based on familial relationships.

In Boynton Beach, the probate process is handled by the 15th Judicial Circuit Court of Florida. For residents of Boynton Beach, the main location is known as Judge Daniel T. K. Hurley Courthouse.

- Judge Daniel T. K. Hurley Courthouse – 205 North Dixie Hwy.

West Palm Beach, FL 33401

Probate Assets

The most relevant factor in determining if probate is necessary is assessing if there are any probate assets as opposed to non-probate assets. Probate assets are those titled in the sole name of the decedent and do not have a beneficiary designation or POD feature. All probate assets are frozen and can only be transferred through the probate process. There are many types of non-probate assets, such as real estate titled in the sole name of the decedent, jointly held property, IRAs and life insurance proceeds payable to a beneficiary, and more.

The most relevant factor in determining if probate is necessary is assessing if there are any probate assets as opposed to non-probate assets. Probate assets are those titled in the sole name of the decedent and do not have a beneficiary designation or POD feature. All probate assets are frozen and can only be transferred through the probate process. There are many types of non-probate assets, such as real estate titled in the sole name of the decedent, jointly held property, IRAs and life insurance proceeds payable to a beneficiary, and more.

The first step in identifying probate assets is to confirm how the decedent’s real estate is titled by visiting the Palm Beach County Property Appraiser. If the property appraiser report and most recent deed confirm that the real estate, aka real property, is in the sole name of the decedent, then probate will be required in order to eventually sell or transfer the property. Often the goal is to sell the piece of real estate during the probate process and to have to proceeds divided among the identified beneficiaries. It is advisable to wait until an estate is open and a personal representative is appointed before executing any type of sales contract.

The second step for identifying probate and non-probate assets is to check the mail of the decedent. Financial institutions and insurance companies will periodically send correspondence regarding accounts. The personal representative of the estate, or the immediate family members of the decedent, should have the decedent’s mail forwarded to a convenient location by requesting a change of address or mail forwarding with the United States Postal Service. The request can be made on the USPS website, or in person at a branch location.

Restricted Depositories

When real property will be sold in probate or a guardianship, only some Florida counties require that the sale proceeds be held in an attorney’s trust account or a restricted depository account. Most formal probate administrations in West Palm Beach utilize restricted depositories. A restricted depository requires court authorization to release funds, including to pay estate expenses. A Petition for an Order to Sell Real Estate must be submitted to the court to authorize the sale of real estate. Unless waived or otherwise ordered, executors must file a bond or place assets in a restricted depository or trust account.

Consult with an experienced Boynton Beach probate attorney for the best techniques for expediting the sale of real property during probate, establishing a restricted depository, and navigating complex court requirements.

Ancillary Probate for Non-Residents

Ancillary probate refers to a secondary probate proceeding that takes place in any state other than the domiciliary state. Ancillary probate is necessary to transfer or sell real estate, aka real property, located in any state other than the decedent’s domiciliary state.

After someone passes away, the first step in the probate process is to establish the domiciliary estate in the decedent’s state of residence. Once a personal representative or executor is appointed for the domiciliary proceeding, the next step is to petition to initiate the ancillary probate in the county in which the real estate is located.

As an example, John lives in California but owns a vacation home in Boynton Beach. When John passes away, his Last Will & Testament must be submitted to his local probate court in California to begin the domiciliary probate process. A second probate process must also be started inBoynton Beach, FL to transfer the home in Boynton Beach to his beneficiaries, or to clear title to a new owner via the sales process.

Generally, ancillary probate administration is required in Florida when someone who was not a Florida resident dies and:

- Owned Florida real estate

- Owned a Florida timeshare

- Owned Florida property or liability that would require the signature of an appointed personal representative in Florida for transfer, collect, or discharge

Ancillary probate in West Palm Beach can complicate the already time-consuming and sometimes costly probate process, but it is the only way to pass Florida real estate to the rightful beneficiaries. Because ancillary probate has the potential to prolong the domiciliary probate proceeding, it’s crucial to work with a skilled Florida ancillary probate attorney.

An experienced ancillary probate lawyer in Boynton Beach can assist with every step of the probate process, and potentially serve as a personal representative to prevent potential delays and finalize the probate as quickly and smoothly as possible.

If you need assistance with probate in West Palm Beach, contact the Florida Probate Law Firm for a free 30 minute consultation at (561) 210-5500.

The Florida Probate Law Firm Proudly Serves All Neighborhoods in Boynton Beach, FL

- Lantana

- Delray Beach

- Lake Worth

- Kings Point

- Palm Springs

- Boca Raton

- Hamptons at Boca Raton

- Palm Beach

- Century Village

- West Palm Beach

- Deerfield Beach

- Royal Palm Beach

If you need assistance with probate in Boynton Beach, contact the Florida Probate Law Firm for a free 30 minute consultation at (561) 210-5500.

Boynton Beach Probate FAQs

The probate process in Boynton Beach can simply be described as the legal proceedings required to transfer title of assets belong to a decedent, into the names of the correct beneficiaries. As a hypothetical, let’s assume your uncle passes away. If at the moment of death, he had property held in his sole name, in order to transfer said property to the beneficiaries under his Will, you will require an order from a probate judge to re-title those assets.

While there are a variety of probate processes, the default route is via a “formal probate.” A formal probate begins with a petition being filed in the probate court identifying the decedent, and identifying the alleged beneficiaries, either via a Will or intestate statutes. Any interested person, usually a beneficiary or the nominated personal representative, can petition the court to appoint a personal representative who will act on behalf of the estate. Once the court grants Letters of Administration and appoints someone to be the personal representative, the estate is initiated.

The personal representative will then proceed to perform the duties that Florida law requires. These duties include gathering probate assets and fling an inventory of the estate’s assets, determining who the estate’s creditors are and giving them notice, paying any debts and taxes the estate owes, and finally distributing the remaining assets to the appropriate beneficiaries. The inventory is typically due within 60 days of obtaining the Letters of Administration. The 90-day creditor period will be initiated by the attorney for the personal representative shortly after the appointment. Only once the creditor period expires can final distributions be contemplated and the paperwork to close the estate be submitted. The probate process is supervised by the court, but it is the appointed personal representative that does most of the leg-work on behalf of the estate.

No, you do not need the original Last Will and Testament in order to start the probate process in West Palm Beach. It is always recommended that you file the original Will if you can find it, but you can start the probate process with a copy of the Will or with no Will at all. If you cannot locate a copy of the original Will, it is a good idea to speak with an experienced Florida probate attorney. The best places to locate a Will are the following:

1.) In the decedent’s home

2.) In the decedent’s safe deposit box

3.) Originals or copies held with the decedent’s estate planning attorney

The short answer to the question is YES, but it also depends on how the decedent’s assets were titled at the time of death. Just because the surviving spouse and/or children are the only beneficiaries, doesn’t automatically mean you can skip the probate process in Boynton Beach. The existence of a Last Will and Testament also does not allow you to skip the probate process. Probate is required whenever someone dies and there are assets in the decedent’s sole name with no beneficiary designations. In response to the question posed above, if the decedent’s assets were all held jointly with the spouse, then there would be no reason for a probate because the assets would pass to the surviving spouse via rights of survivorship, outside of the probate process. For example, if the title of the house is in both your name and your spouse’s name, the title of the house would automatically pass to you once your spouse dies.

Some assets bypass the probate process, even if the decedent mentions them in the Will. These assets pass to the surviving joint owner, or designated beneficiary upon the decedent’s death under the terms of the document that governs them. For example, a bank account with a payment on death (POD) feature does not go through the probate process, but passes directly to the person the decedent named as a beneficiary in the bank documents, often executed when establishing the account. Other examples of assets that typically pass to the beneficiaries according to the terms of their own documentation rather than the terms of the decedent’s will include investment accounts, retirement accounts, and life insurance proceeds.

If you are not sure whether a probate is required, you should consult an experienced probate attorney. It is a good rule of thumb that an original Last Will & Testament should always be deposited with the Clerk of Court in the county where the decedent resided at the time of death, whether you think a probate is necessary or not. If assets are discovered many months or years after death and a probate is necessary, it will be easier to initiate the process if the original Will is filed with the clerk’s office.

Boynton Beach Probate FAQs

The personal representative will be responsible for filing the final individual income tax return (Form 1040) for the person who passed away, as well as any necessary estate income tax return (Form 1041). Estate income tax returns are only required if estate assets generate more than $600 of income annually.

In Florida, there’s no state-level death tax or inheritance tax, but there is still a federal estate tax requirement, so if an estate focused in Boynton Beach is valued at more than $11 million, there is a potential federal estate tax bill, and then a return would have to be filed (Form 706). The number of estates that require a Form 706 to be completed is minuscule. For any probate tax matter, it is important to work with an experienced Florida probate attorney and accountant.

The probate process in Boynton Beach can be a prolonged and expensive undertaking. There are many factors that can affect the course of administration, such as the complexity of the estate, the number of beneficiaries, and the number of potential creditors. One of the most important factors in assessing the total expense of the administration will be whether the interested parties are cooperating or are adversarial. An adversarial proceeding, such as a will contest, is going to greatly increase the amount of legal work and discovery required in order to settle the estate.

State law also affects the cost of probate. Florida, unlike many states in the northeast, has extensive requirements for the probate process, including that an attorney must hired in order to initiate a formal probate proceeding. Florida probate code also requires publication of notice to creditors in the local newspaper for two consecutive weeks in order to initiate the 90 day creditor period. Some typical expenses that you may experience during the probate process include an appraisal, the cost for a surety bond, court filing fee, legal fees, and cost of any accountings.

Before initiating the probate process in Boynton Beach, this is one of the primary questions asked by family members or beneficiaries.

From start to finish, the duration of the probate process can vary significantly. Predicting how long the probate process will take depends on which state you are conducting the administration in, and will vary depending on the size and complexity of the estate. There are many factors to consider – for instance, the size and value of the decedent’s assets, outstanding debts owed by the decedent, number of beneficiaries, tax implications, probate procedural requirements, etc. In Florida, on average, the probate process will range from 6 to 12 months, although in certain situations it can take longer, such as for adversarial proceedings. Apart from size and complexity what can hold back a probate case?

Often, the delays come from waiting for information from third parties. It’s always advisable to hire an expert probate attorney. Professional probate attorneys understand the processes involved and can use their experience to expedite the proceeding, predict what information will be necessary from the inception of the estate, and work through each case thoroughly and efficiently.

Boynton Beach Probate FAQs

Unfortunately, the probate process in Royal Palm Beach is tedious and can require an extensive amount of time to complete. To avoid the whole cumbersome process, it’s necessary that your estate plan be set up properly at the time of death, so that there are no assets titled in your sole name. The use of beneficiary designations on accounts is useful, but limited since they can only be utilized on certain assets and the designations do not assist in the event of incapacity. Establishing a revocable trust is the most common means of avoiding probate recommended by the estate planning community. It is critical that your assets actually be titled in the name of the revocable trust before death, in order to avoid the probate process.

Other tools for avoiding probate include transferring your property to your loved ones as a gift during your lifetime. Alternatively, you can establish joint ownership for your assets, so that ownership will be transferred automatically to the surviving owner(s) upon death. These alternative tools for avoiding probate have drawbacks, namely that you must give up complete control of your assets during your lifetime which makes many people are uncomfortable.

Ultimately, before you utilize any steps to avoid probate, consider seeking professional advice from an experienced probate attorney located near Royal Palm Beach.

Florida Statute Section 733.702 directs that to file a claim against an estate, a creditor shall file a written statement of the claim in the probate proceeding. When filing a claim, it is advisable to attach supporting documentation to substantiate the amounts owed by the decedent, or his/her estate, such as executed contracts or invoices. If a decedent owed you money, it is important that you consult with a Florida attorney to make sure you follow the correct steps to get your claim paid.

There is a limited amount of time to file claims against an estate in Royal Palm Beach, so it’s pivotal you don’t miss the deadline. With any formal probate administration in Florida, the court requires a 90-day (3 month) creditor period to be initiated by publishing a “Notice to Creditors” in a local newspaper. During that 90-day period, any known or unknown creditors of the decedent will be able to file claims, and often times it’s a collections agency working for a creditor that ends up searching for these publications and files the necessary claims. If the personal representative receives statements in the mail regarding unpaid bills or debts, then the attorney for the personal representative will mail those identified entities directly with the “Notice to Creditors”. Any party that is mailed a Notice to Creditors, will need to file their claim within 30 days of receiving the notice, or within the 90-day creditor window, whichever expires later.

Once you file your claim, the personal representative of the estate will either pay the claim, object to the claim, or attempt to settle the claim for some reduced amount. Other interested persons, such as beneficiaries, may also file objections to your claim. If the personal representative or another interested party files an objection to your claim, you have only 30 days to make your next move, although the court may extend that time for good cause. In order to preserve your claim after an objection, you will need to file an independent civil suit against the estate, which is an independent lawsuit in the civil division rather than in the probate court. Filing an independent civil suit includes paying a filing fee for initiating the lawsuit.

Following the death of a loved one in Royal Palm Beach, family members are often confused and overwhelmed with the probate process. When it comes to transferring the decedent’s property, the family must make an informed decision as to what type of probate administrations are available, which will vary depending on the state. In Florida, there are two primary types of probate, including

1.) Formal Probate Administration

2.) Summary Administration

A summary administration is only available for estates valued under $75,000, but important to rememebr that simply because an estate may be small enough to qualify for a summary administration, doesn’t mean it is the most efficient option.

Often a formal administration, involving the appointment of a personal representative with signing authority, can assist in expediting the overall administration. As such, hiring an attorney to assist in the process is a crucial step in the probate process so that all factors can be considered before initiating the process. In Florida, families are legally required to hire an attorney to assist with a formal probate proceeding. The attorney will be identified as the attorney of record for the estate.

In the beginning stages, an attorney will assist you in the probate process by initially filing the will and pleadings for the appointment as personal representative. After this initial filing, the attorney will be responsible for filing any future pleadings that may be necessary during the probate process including the inventory and final accounting. The attorney on record will be responsible for mailing notice to all interested parties throughout the process.