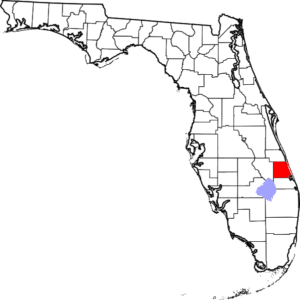

St. Lucie County, FL Probate Process For Residents & Non Residents

Useful Resources for Probate in Lucie County, FL

In Florida, probate is a court-supervised process in which a deceased person’s assets are identified and beneficiaries are determined. The probate process is designed to ensure that potential creditors have an opportunity to pursue claims against the estate, as well as provide a forum for identifying the correct beneficiaries to receive the decedent’s property.

Florida Probate Process

When someone passes away leaving a valid Last Will & Testament, anyone with possession of the Will must file the original document with the correct circuit court, aka probate court. The original Last Will & Testament and any probate pleadings will be filed in the county of last residence for the decedent. For example, if the decedent passed away as a resident of Port St. Lucie, then St. Lucie County would be the correct jurisdiction for a domiciliary probate proceeding. If there is no Last Will & Testament for the decedent, then any probate assets will be distributed according to the Florida intestacy statute, which provides a default distribution scheme for assets based on familial relationships.

In St. Lucie County, the probate process is handled by the 19th Judicial Circuit Court. Depending on the petitioner’s address, the county will determine which courthouse the case is assigned to. Because the 7th Judicial Circuit Court oversees cases in four counties, there are six courthouses in the circuit. There are five Courthouse locations in St. Johns County and the 19th Judicial Circuit Court but only two locations in St. Lucie as the 19th Circuit Court covers four counties.

- Saint Lucie County Courthouse – 218 S 2nd St., Fort Pierce, Fl 34950

- Saint Lucie County West Annex – 250 NW Country Club Dr., Port Saint Lucie, Fl 34986

- Martin County Courthouse – 100 SE Ocean Blvd, Stuart, Fl 34994

- Indian River County Courthouse – 2000 16th Ave, Vero Beach, Fl 32960

- Okeechobee County Courthouse – 312 N.W. 3rd St., Okeechobee, Fl 34972

Probate Assets

The most relevant factor in determining if a probate is necessary is assessing if there are any probate assets as opposed to non-probate assets. Probate assets are those titled in the sole name of the decedent, and do not have a beneficiary designation or POD feature. All probate assets are frozen and can only be transferred through the probate process. There are many types of non-probate assets, such as real estate titled in the sole name of the decedent, jointly held property, IRAs and life insurance proceeds payable to a beneficiary, and more.

The first step in identifying probate assets is to confirm how the decedent’s real estate is titled, by visiting the St. Lucie County Property Appraiser. If the property appraiser report and most recent deed confirm that the real estate, aka real property, is in the sole name of the decedent, then a probate will be required in order to eventually sell or transfer the property. Often the goal is to sell the piece of real estate during the probate process, and to have the proceeds divided among the identified beneficiaries. It is advisable to wait until an estate is open, and a personal representative is appointed before executing any type of sales contract.

The second step for identifying probate and non-probate assets is to check the mail of the decedent, since financial institutions and insurance companies will periodically send correspondence regarding accounts. The personal representative of the estate, or the immediate family members of the decedent, should have the decedent’s mail forwarded to a convenient location by requesting a change of address or mail forwarding with the United States Postal Service. The request can be made on the USPS website, or in person at a branch location.

Restricted Depositories

Sometimes formal probate cases in the 19th Circuit Court (St. Lucie County) require a restricted depository. This depository is like a bond and it’s a court-restricted bank account in the estate’s name. The account holds estate funds during probate. When a restricted depository is required, a court order is necessary to release any estate funds from the depository to pay estate expenses and distribute funds to beneficiaries or heirs. Restricted depositories are not required for all probate administrations in the 19th Circuit Court.

Consult with an experienced St. Lucie County probate attorney for the best techniques for establishing a restricted depository and expediting the administration.

Ancillary Probate for Non-Residents

Ancillary probate refers to a secondary probate proceeding that takes place in any state other than the domiciliary state. Ancillary probate is necessary to transfer or sell real estate, aka real property, located in any state other than the decedent’s domiciliary state.

After someone passes away, the first step in the probate process is to establish the domiciliary estate in the decedent’s state of residence. Once a personal representative, or executor is appointed for the domiciliary proceeding, the next step is to petition to initiate the ancillary probate in the county in which the real estate is located.

As an example, John lives in California but owns a vacation home in Port St. Lucie. When John passes away, his Last Will & Testament must be submitted to his local probate court in California to begin the domiciliary probate process. A second probate process must also be started in St. Lucie County, Florida to transfer the home in Port St. Lucie to his beneficiaries, or to clear title to a new owner via the sales process.

Generally, ancillary probate administration is required in Florida when someone who was not a Florida resident dies and:

- Owned Florida real estate

- Owned a Florida timeshare

- Owned Florida property or liability that would require the signature of an appointed personal representative in Florida for transfer, collect, or discharge

Ancillary probate in St. Lucie County, Florida can complicate the already time-consuming and sometimes costly probate process, but it is the only way to pass Florida real estate to the rightful beneficiaries. Because ancillary probate has the potential to prolong the domiciliary probate proceeding, it’s crucial to work with a skilled Florida ancillary probate attorney.

An experienced ancillary probate lawyer in St. Lucie County can assist with every step of the probate process, and potentially serve as a personal representative to prevent potential delays and finalize the probate as quickly and smoothly as possible.

If you need assistance with probate in St. Lucie County, Florida, contact the Florida Probate Law Firm for help through every step of the process at (561)-210-5500.

The Florida Probate Law Firm proudly serves all municipalities in St. Lucie County, FL

- City of Fort Pierce

- City of Port St. Lucie

- Village of St. Lucie

- Ankona

- Eden

- Eldred

- Fort Pierce North

- Fort Pierce South

- Hutchinson Island South

- Indian River Estates

- Lakewood Park

- North Hutchinson Island

- River Park

- Walton

- White City

If you need assistance with probate in St. Lucie County, Florida, contact the Florida Probate Law Firm for help through every step of the process at (561)-210-5500.